This time the Sunshine State’s issues are man-made

by Jonathan Kent

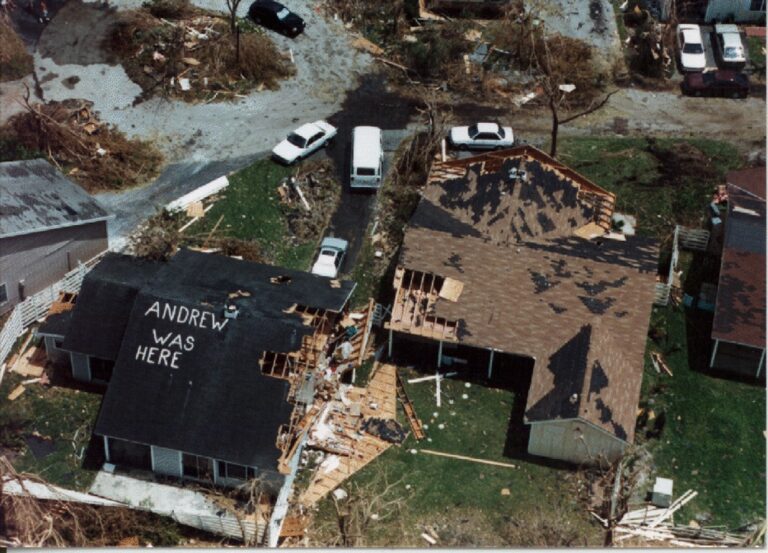

Few events have been as important to Bermuda’s economic history as Hurricane Andrew. Thirty years ago, the Category 5 storm caused damage on a previously uncontemplated scale, rendered 11 US insurers insolvent and resulted in a fundamental change in how catastrophic risk was insured.

The gaping hole it left in property insurance capacity, combined with a spike in demand for coverage, created an opportunity, as rates for reinsurance tripled. Mid Ocean Re was the first reinsurer to be set up in Bermuda in November 1992, barely three months after the storm had left a trail of destruction in southern Florida. In the ensuing months, nine more reinsurers followed.

On those foundations was built Bermuda’s world-leading catastrophe risk reinsurance industry and decades of innovation that produced sophisticated modelling, catastrophe bonds and insurance-linked securities. This era has also established the island as the place to put capital to work to cover other emerging and complex global risks, from professional liability and mortgage, to cyber and life reinsurance.

Robert Hartwig, Director, Risk and Uncertainty Management Center at the University of South Carolina’s Darla Moore School of Business, said that in the run-up to Andrew insurers had been eager to take the premium from a growing population in Florida while underestimating their accumulating risk exposure.

“It was a ticking time bomb and in August 1992, it exploded,” Dr Hartwig said. “About 18 months later, the industry was shaken out again by the Northridge earthquake in California. It became clear that they lacked the ability to model large-scale catastrophic risks — and until that was possible, investors were reluctant to commit capital.”

Following Mid Ocean Re’s blueprint, came a wave of new reinsurers, including two still operating today, RenaissanceRe and PartnerRe. Centre Cat, LaSalle Re, International Property Catastrophe Re, Tempest Reinsurance, Global Capital Re, Compass Re and Starr Excess Liability also drew investments from insurance brokers and insurers, investment banks and private equity. In total, Bermuda’s Class of 1993 raised $4.8 billion.

The Bermudian newcomers brought to market not only capital to restore underwriting capacity, but also a more measured, scientific approach using complex models. Validated by its dependable claims-paying track record, Bermuda has become to go-to market for global property-catastrophe risk, particularly US risk. Today, Bermudian companies provide approximately 60 per cent of the hurricane reinsurance for wind-prone Florida and Texas, according to the Association of Bermuda Insurers and Reinsurers.

“I don’t think that Bermuda could have understood back in 1992 how much of an influence they would have on allowing insurers and reinsurers to underwrite severe catastrophic risks on a global scale,” Dr Hartwig said.

“The Bermuda model has been so successful, it’s been replicated. It’s quite amazing, the relative stability that we’ve seen in global property insurance and reinsurance markets, despite the threat of climate change. When you look at the expectation for future natural disaster losses around the world, then the advances in modelling that began with Andrew will be more essential than ever.”

Southern Florida bore the brunt of Andrew’s destructive rampage, as entire towns were razed. Three decades on, Florida faces another insurance crisis, one which has left at least four property insurers insolvent and many more seeking hefty premium hikes, or not renewing policies. This time, the issue is not a storm — there have been no direct hurricane hits on the Sunshine State in the past three years.

“Floridians are seeing homeowners’ insurance become costlier and scarcer, because for years the state has been the home of too much litigation and too many fraudulent roof-replacement schemes,” Sean Kevelighan, CEO of the Insurance Information Institute, said.

The Florida Office of Insurance Regulation reported that of the $51 billion paid out by Florida insurers over a ten-year period, 71 per cent went to attorney and adjuster fees. Florida is also the site of 79 per cent of homeowners’ insurance lawsuits filed in the US, but only 9 per cent of claims.

Dr Hartwig said: “The current crisis in Florida’s property re/insurance markets is largely man-made and therefore, avoidable. The state also faced a crisis after the record hurricane activity of 2004/05 in which it actively suppressed rates, causing many insurers to withdraw or reduce capacity.

“Hence, Florida has a history of compounding its already formidable risk from natural disaster with man-made — that is, political and litigation — risk. These are self-inflicted wounds. It’s not clear that the state will ever truly learn from its mistakes.”

History is repeating itself, as insurers and reinsurers alike are reducing their exposures in Florida, leaving Citizens, the state-owned insurer of last resort, taking on hundreds of thousands of extra customers who cannot find private home insurance.

RenaissanceRe said in May that it had steadily reduced its exposure to Florida homeowners’ risk, which now represents just 2.5 per cent of its gross written premium. Speaking in RenRe’s first-quarter earnings conference call, CEO Kevin O’Donnell said: “Florida has a social inflation problem that can’t be solved by rate, because it is ultimately impossible to know how much to charge to cover fraud. It now also has a capacity problem, due to reduced third-party capital appetite, limited retro availability, and severe financial distress at many domestic Florida insurers.”

The crisis forced politicians into action and in June the Republican-controlled state legislature pushed through insurance reforms designed to reduce the number of lawsuits against insurers, among other things.

Dr Hartwig did not expect a rush of new risk capital to be committed to Florida, but said that the industry was cautiously optimistic of a favourable impact. “Fraud does not lend itself to be modelled,” Dr Hartwig added, “as the rules of the game can be changed at any time by the legislature.”

Florida’s population rose by 8 million, or 58 per cent, between 1992 and 2021, according to US Census Bureau data. With 21.7 million residents, it is now the third most populous US state. As more people move in and global warming brings more frequent and severe hurricanes, insurance market stability is critical.

“We hear some catastrophic climate change predictions, but we don’t hear reinsurers say they are not up to the task,” Dr Hartwig said. “They understand that they can bring their models and their capital to bear in a riskier world.

“What we have learnt in the past 30 years is that the ability to model and manage catastrophic risks is great, but when there is extreme interference by regulators and attorneys, who are seeking to essentially suppress market forces for their own political or economic benefit, that’s when the market becomes the most disrupted.”