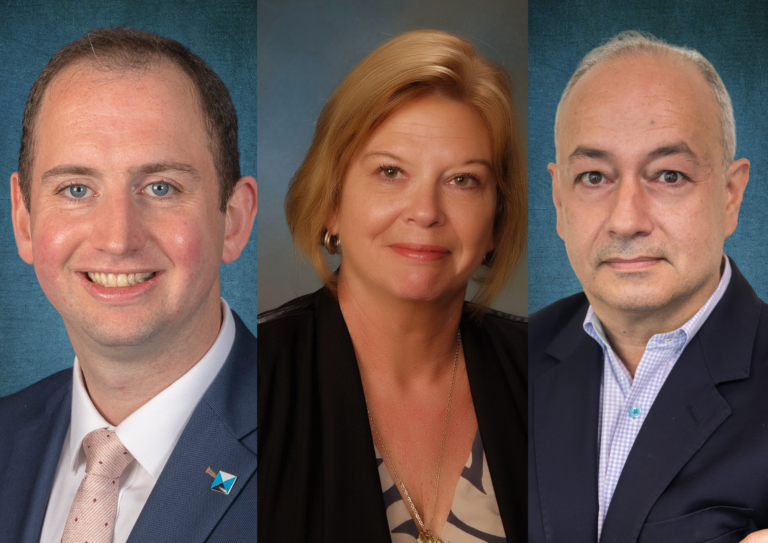

(In photo: Alex Whittaker, Linda Longworth, and Claudio Satasi)

In times gone by, Bermuda was the go-to place for high-net-worth families to preserve their wealth for the benefit of future generations, allowing the island to develop a trusted legislative and regulatory framework, and become a hub for world-class service providers.

While this technical expertise remains, other jurisdictions such as the Cayman Islands, Channel Islands, Switzerland, Singapore and the United Arab Emirates (UAE) have successfully increased the competition for this business, reducing Bermuda’s ability to stand out from the crowd in this respect.

Hamilton Trust Company Limited, part of the Moore Family Office Group, is one of the longest established trust businesses in Bermuda. Linda Longworth, managing director, Claudio Satasi, finance director, and Alex Whittaker, client director, shared their perspectives on this increased competition, along with the challenges and opportunities for Bermuda’s trust businesses, and why a family trust is still an effective structure to ensure a longstanding legacy for future generations.

The three main reasons why a family trust is established are tax planning, asset protection and succession of wealth. While appropriate tax planning remains important, the other two reasons are becoming more so, particularly against the backdrop of turbulent political and economic events, like those now taking place in the US.

To put the significance of this into context, Ms Longworth said historically, offshore trusts are less appealing for US citizens from a tax perspective. Recently however, they have received a lot more interest from Americans wanting to structure a trust in Bermuda and “willingly” pay whatever tax they have to pay.

Another benefit of family trusts is flexibility. As families grow, trusts can be incorporated within a private trust company (PTC) structure and they can also be restructured to meet the needs of younger generations: “Trust law develops over time and it continues to stay relevant to what families require, and I think Bermuda does well keeping up with that,” said Mr Whittaker.

Often, the younger generation will also have new ideas about how they want their legacy to be invested. In particular, they want to have an impact: “More green and socially responsible investing,” said Ms Longworth. “They also want to steer away from certain investing,” added Mr Satasi. “We have some that want to steer away from high tech that use low cost labour. They’ll stay away from oil and gas.”

Additionally, many want to pivot from what previous generations have done and Mr Whittaker pointed out that it’s their role to find the most effective way to help them achieve this: “Do they want to open their own business? Do they want to be entrepreneurial? Do they want to be charitable? It’s about finding a way through the family structure to assist them in their goals.”

In terms of newer wealth and new business opportunities, jurisdictions such as Singapore and the UAE are benefiting from the rise in high-net-worth individuals in Asia because traditionally, the heads of those families want to keep their wealth administration hubs close to home. This may change however as the next generation, many of whom have been educated in North America and Europe, come to the fore.

Where they see more immediate opportunity however, is from Latin America, as many of those families want their wealth kept further away from home: “We saw a lot of that with some of the more politically turbulent countries in the region, such as Venezuela, where many of its high-net-worth families, who would traditionally look to Curacao for civil law reasons, then thought: ‘Actually, that’s a bit too close to home’. A lot of these Latin American families also have physical protection concerns,” he explained.

Over recent years, families and their advisers from civil law countries have become more knowledgeable of common law trust legislation. For Latin America, the Cayman Islands and British Virgin Islands (BVI) have seized this opportunity, but Bermuda’s link with Miami along with more positive jurisdictional marketing, could attract more of these families here instead.

While more should be done to market Bermuda to high-net-worth families around the world, initiatives such as the Economic Investment Residential Certificate (EIRC) and the proposals to introduce a more structured family office framework, along with foundation company legislation, could appeal to families who otherwise wouldn’t consider this jurisdiction.

“Bermuda, back in the heyday, was the hub where you set up high-value trusts. There’s no reason why we can’t get back to that,” said Mr Whittaker.