In photo: Marico Thomas, left, and Danielle Riviere of the Bermuda Chamber of Commerce (Photograph by Blaire Simmons)

Bermuda’s economy has changed markedly over the past 30 years and international business has become a much larger part of it.

That was one clear takeaway from the Bermuda Chamber of Commerce’s “Deep Dive” — an extraordinary release of data, illustrated in a series of graphs, which have provided much food for thought for business leaders, policymakers and the community.

A handful from the trove of eye-opening statistics:

- IB generates more than one third of Bermuda’s total employment income, or 34.5 per cent, up from 11.6 per cent in 1997; over the same period hospitality and retail’s share of wages has fallen from 20.4 per cent to 10.4 per cent

- The number of IB jobs rose by 984, or 25 per cent, between 2019 and 2023 — Bermudians and their spouses, and permanent resident certificate holders accounted for 55 per cent of this job growth; high-value insurance jobs were a feature, with the number of underwriters up 26 per cent and actuaries up 45 per cent

- From 1993 through to 2023, hotel and guest house room count fell by 56.6 per cent, while jobs in the accommodation sector fell by two-thirds

- Retail sales volume fell 8% between 1995 and 2023, while the number of jobs filled has fallen 3.6% — there is a notable correlation between the two statistics over the past three decades.

Marico Thomas, Chamber president, and Danielle Riviere, chief executive officer, came into their roles last year with a mission of providing data to provide a much-needed factual basis for conversations on the island’s future.

The Chamber’s Economics Division led the research and the results were unveiled in February at the Chamber’s Budget Breakfast, where David Burt, the Premier and Finance Minister, was a special guest.

While the aim of the Deep Dive was to provide accurate, actionable information, rather than offer opinions based on it, Mr Thomas said it was clear there had been structural changes in the economy.

“There was a time when tourism was the big gorilla of the Bermuda economy and taking a career path as a bartender would allow me to buy a house, or buy a taxi, and put my kids through college,” Mr Thomas said.

“That has changed. The story around international business when I was a teen is remarkably different from the ‘what do you want to be when you grow up?’ conversation I have with my kids. When you look at two data points — IB’s share of GDP and tourism’s, the 1980s and 1990s compared to now — you can see that the conversations in business meetings will also be different.

“Some of those impacts have not necessarily resonated throughout the conversations in every dining room and boardroom — you have some people who still reflect on how things once were. We are just trying to ensure that people are having those conversations based on accurate information.”

Ms Riviere stressed that the Deep Dive was only the start of a more data-driven Chamber. With plans for more data releases in future, the Chamber is urging members to share information when asked to help paint as accurate a picture as possible.

“This is not a one-off conversation,” Ms Riviere said. “It’s not just about the data, we really want people to understand that good information can help to change behaviours.”

A useful indicator of IB’s impact comes from the Association of Bermuda Insurers and Reinsurers’ annual economic substance report. ABIR, which represents many of the largest international re/insurers with operations on the island, has tallied a staggering direct impact of $12.84 billion on Bermuda’s economy over the past 15 years.

Included in ABIR’s calculations are salaries and benefits for locally based employees, travel and entertainment in Bermuda, including hotels, airfares, restaurants, taxis and catering, and donations to Bermuda charities, which totalled nearly $6 million in 2022 alone.

IB workers earned more than $1.3 billion in 2022, a significant injection of money into the local economy. The imminent corporate income tax, Bermuda’s response to the OECD’s global minimum tax, effective from January next year and levied on large multinational companies, is expected to massively increase the impact of IB. Mr Burt has estimated the new tax could raise $750 million per year — equivalent to about 60 per cent of the Government’s revenue estimate for the current fiscal year.

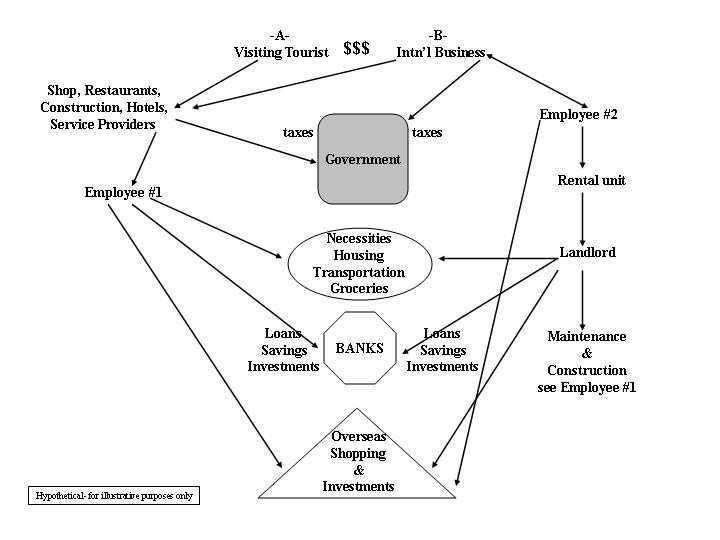

All this creates a “multiplier effect” with IB dollars coming into the economy circulating through multiple transactions of many kinds, from taxis and restaurants to rents and retailers.

However, Martha Harris Myron, a former financial adviser who was The Royal Gazette’s personal finance columnist for more than 20 years, cautions that statistics showing healthy GDP growth do not capture how much of the money is flowing straight off island.

“I believe Bermuda has a fragmented multiplier effect, for many reasons,” Ms Harris Myron said. “One is the high increase in money moved and spent abroad. Many IB workers are paid in US dollars and my impression is that many of their investments and savings are in overseas brokerage accounts and banks, including their pension funds, whose custodians are abroad.

“They also purchase properties overseas, partly because of the high prices on the island. I remember many years ago I had a client who said his family went to Florida and bought five houses — one for them and one each for the four children — for the price of one home in Bermuda!

“Many of our largest domestic companies are completely or partially foreign-owned, such as Belco, Butterfield Bank, HSBC (formerly the Bank of Bermuda), BF&M, Clarien and One Communications, so their profits and dividend payments flow off island.

“Then there is the money that we spend every year buying fossil fuels from overseas and the huge amount we pay to service the Government’s $3 billion-plus debt, nearly all of which is financed by US dollar bonds. I don’t understand why we do not have more Bermuda dollar-denominated bonds, so the Government’s interest payments would stay in Bermuda, instead of going to foreign creditors.”

Ms Harris Myron cautions against pinning high hopes on the corporate income tax. “We just don’t know if it will be an economic life-saver,” she said.

She is also concerned there may be a lack of foreign currency held in reserve in Bermuda — needed to fund overseas transactions. “The Government used to provide this number, but I cannot find it now,” she said. “I think everyone keeps hoping that US dollars keep flowing in from international business.”